Personal finance involves managing income, expenses, savings, and investments to achieve financial stability. It empowers individuals to make informed decisions about money management and long-term planning.

1.1. Understanding the Importance of Financial Literacy

Financial literacy is crucial for effectively managing personal finances, enabling individuals to make informed decisions about budgeting, saving, and investing. It empowers people to achieve financial stability, avoid debt, and build wealth. Resources like Personal Finance textbooks by Diana J. Beal and George Callaghan provide essential insights, helping readers navigate financial planning and improve their economic well-being through practical strategies and tools.

1.2. Overview of Personal Finance Textbooks and Resources

Popular textbooks like Personal Finance by Diana J. Beal and George Callaghan offer comprehensive guides for managing finances. Resources include workbooks, online courses, and tools like budgeting apps. Textbooks such as The Infographic Guide to Personal Finance by Michele Cagan provide visual aids for better understanding. These materials cover topics from budgeting to investing, ensuring a well-rounded financial education for readers of all levels.

Budgeting and Expense Management

Budgeting and expense management are crucial for financial stability. They help track income, allocate resources, and prioritize spending to achieve long-term goals like saving and investing effectively.

2.1. Creating a Personal Budget

Creating a personal budget involves assessing income, expenses, and financial goals. It helps allocate resources effectively, ensuring savings and investments align with long-term objectives. Start by tracking income sources and categorizing expenses into needs, wants, and debts. Set realistic targets for savings and emergency funds. Regularly monitor spending to stay on track and adjust as financial situations change. Utilize budgeting apps or spreadsheets for better management.

2.2. Tracking Income and Expenses

Tracking income and expenses is crucial for effective financial management. Start by documenting all sources of income and categorizing expenses into needs, wants, and debts. Use budgeting apps or spreadsheets to monitor spending habits. Regularly review financial statements to identify trends, cut unnecessary costs, and allocate resources wisely. This practice helps maintain financial balance and achieves long-term goals.

Managing Debt

Managing debt is essential for financial health. It involves understanding debt types, prioritizing high-interest debts, and implementing strategies to pay them off while maintaining a good credit score.

3.1. Types of Debt and Their Implications

Debt can be categorized into secured, unsecured, revolving, and installment types. Secured debt requires collateral, while unsecured debt relies on creditworthiness. Revolving debt, like credit cards, allows repeated use, and installment debt involves fixed payments over time. Each type carries different risks and repayment terms, impacting credit scores and financial stability. Understanding these distinctions is crucial for effective debt management.

3.2. Strategies for Paying Off Debt

Effective strategies for paying off debt include the debt snowball method, targeting high-interest debt first, and consolidating loans. Creating a repayment plan with clear timelines and sticking to it is essential. Increasing income, reducing expenses, and prioritizing needs over wants can accelerate debt repayment. Communicating with creditors and building an emergency fund can also help avoid further debt accumulation and ensure long-term financial stability.

Savings and Emergency Funds

Savings and emergency funds are crucial for financial stability. They provide a safety net for unexpected expenses and help maintain financial health during challenging times.

4.1. Building an Emergency Fund

Building an emergency fund is crucial for financial stability. It serves as a safety net for unexpected expenses like medical bills or car repairs. Aim to save 3-6 months’ living expenses in a liquid account. Start small, automate savings, and gradually increase contributions. Avoid dipping into it for non-essentials. This fund ensures you can cover emergencies without debt, maintaining financial peace of mind.

4.2. Long-Term Savings Strategies

Long-term savings strategies focus on securing future financial goals, such as retirement or major purchases. Start by setting clear objectives and automating savings. Utilize tax-advantaged accounts like 401(k)s or IRAs. Diversify investments to grow wealth steadily. Avoid withdrawing from long-term savings for short-term needs. Consistency and patience are key to building substantial long-term savings over time, ensuring financial security and achieving lasting goals effectively.

Investing and Wealth Growth

Investing is a powerful tool for growing wealth over time. By diversifying investments and understanding risk, individuals can build portfolios that align with their financial goals and timelines.

5.1. Basics of Investing

Investing begins with understanding key concepts such as risk tolerance, diversification, and compound interest. It involves selecting assets like stocks, bonds, and mutual funds. A well-rounded portfolio balances risk and reward, aligning with individual goals. Starting early allows for growth over time, even with small contributions. Regular portfolio reviews ensure alignment with changing financial objectives and market conditions.

5.2. Retirement Planning and Investments

Retirement planning involves creating a sustainable income stream post-work. Key investment vehicles include 401(k)s, IRAs, and Roth IRAs. Diversifying investments across stocks, bonds, and mutual funds helps mitigate risk. Early contributions benefit from compound growth, while consistent portfolio monitoring ensures alignment with retirement goals. Employer matching contributions should be maximized to boost savings efficiency and secure long-term financial stability.

Understanding Credit Scores

Credit scores reflect an individual’s financial health, impacting loan approvals and interest rates. A higher score enhances financial opportunities and reduces borrowing costs significantly.

6.1. Importance of Credit Scores

Credit scores are crucial for securing loans, credit cards, and favorable interest rates. They reflect financial responsibility, influencing mortgage approvals and apartment rentals. A high score can save money through lower interest rates and better loan terms. Employers and landlords may also review credit history. Maintaining a good score enhances financial flexibility and access to credit, making it essential for long-term financial health and stability.

6.2. Improving and Maintaining a Good Credit Score

Improving credit scores involves paying bills on time, reducing debt, and avoiding new credit inquiries. Monitoring credit reports for errors and maintaining a long credit history also help. Keeping credit utilization below 30% demonstrates financial discipline. Consistently practicing these habits ensures a strong credit profile, enhancing financial opportunities and reducing borrowing costs over time.

Retirement Planning

Retirement planning ensures financial security post-work, requiring early savings and investments. It involves strategies like pension funds, IRAs, and 401(k)s to build a sustainable income source for the future.

7.1. The Importance of Early Retirement Planning

Early retirement planning is crucial for securing financial stability in later life. It allows individuals to build significant savings, leverage compound interest, and explore investment options like 401(k)s or IRAs. Starting early helps address challenges like increased life expectancy and uncertain future income, ensuring a sustainable retirement income stream and peace of mind.

7.2. Retirement Savings Options

Retirement savings options include employer-sponsored plans like 401(k)s and 403(b)s, offering tax benefits and potential employer matches. IRAs, such as Roth or Traditional, provide flexibility for individuals. Annuities and pension plans are additional choices, while tools like retirement calculators and financial advisors help tailor strategies to individual goals, ensuring a secure financial future. Diversification is key to optimizing these options effectively.

Financial Goals and Planning

Setting clear financial goals and creating a tailored plan helps achieve stability and prosperity, guiding decisions on saving, investing, and managing resources effectively.

8.1. Setting Short-Term and Long-Term Financial Goals

Setting financial goals involves defining clear, achievable objectives, such as saving for emergencies or retirement. Short-term goals are typically accomplished within a year, like building an emergency fund, while long-term goals, like buying a home, take years. Prioritizing and creating a timeline helps align resources with aspirations, ensuring progress toward financial stability and success.

8.2. Creating a Personalized Financial Plan

A personalized financial plan tailors strategies to individual needs, income, and goals. It includes budgeting, debt management, savings, and investment. Regular monitoring ensures adaptability to life changes, promoting financial health and security. Tools like workbooks and apps assist in tracking progress, helping individuals maintain discipline and achieve lasting stability.

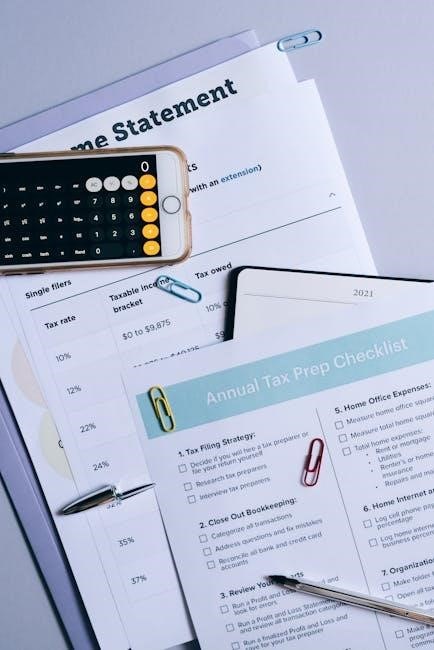

Tax Planning and Optimization

Tax planning involves strategies to minimize liabilities and maximize refunds, ensuring compliance with regulations while optimizing financial health.

9.1. Understanding Tax Basics

Understanding tax basics is crucial for effective financial management. It involves knowing types of taxes, such as income, property, and sales taxes, and how they apply to individuals. Tax brackets, deductions, and credits are key concepts to grasp. Familiarizing yourself with tax laws and regulations ensures compliance and helps optimize your financial health. This knowledge enables smarter decisions and avoids unnecessary liabilities.

9.2. Tax Strategies for Personal Finance

Tax strategies are essential for optimizing your financial health. Maximizing deductions, utilizing tax credits, and leveraging retirement contributions can reduce liabilities. Understanding tax-advantaged accounts, such as IRAs and 401(k)s, helps in long-term planning. Maintaining accurate records ensures compliance and maximizes refunds. Staying informed about tax law changes allows for informed decisions, minimizing obligations while enhancing savings and overall financial security.

Insurance and Risk Management

Insurance is a cornerstone of financial security, protecting against unforeseen events. It includes health, life, auto, and home coverage, safeguarding assets and income from unexpected risks and losses.

10.1. Types of Insurance for Personal Finance

Insurance protects against financial losses, with key types including health, life, disability, auto, and home insurance. These coverages safeguard income, assets, and well-being, ensuring stability during unforeseen events. Health insurance manages medical expenses, while life insurance provides for dependents. Disability insurance replaces lost income, and auto and home policies protect valuable possessions from damage or loss, offering peace of mind and financial security.

10.2. Importance of Insurance in Financial Planning

Insurance is a cornerstone of financial planning, offering protection against unforeseen events. It mitigates risks, safeguards assets, and ensures continuity of income. By covering medical, property, and life risks, insurance provides stability, allowing individuals to recover from setbacks without financial ruin. This safety net is essential for long-term security and peace of mind, making it a vital component of any comprehensive financial strategy.

Monitoring and Adjusting Your Financial Plan

Regularly reviewing your budget, income, and expenses ensures alignment with financial goals. Adjustments may be needed to reflect changes in income, expenses, or life circumstances, ensuring long-term success.

11.1. Regular Financial Check-Ups

Regular financial check-ups are crucial for maintaining financial health. Reviewing budgets, income, and expenses helps identify trends and areas for improvement. Adjustments can be made to stay on track with savings goals or address unexpected expenses. Utilizing tools like budgeting apps or spreadsheets can streamline the process, ensuring a clear overview of one’s financial situation and progress toward long-term objectives.

11.2. Adapting to Life Changes

Life changes, such as job shifts, marriage, or having children, require adjustments to financial plans. Updating budgets, insurance, and savings strategies ensures alignment with new priorities. Flexibility and proactive planning help navigate these transitions smoothly, maintaining financial stability and security.

Additional Resources for Learning

Explore textbooks like “Personal Finance” by Diana J. Beal and online courses for in-depth learning. Utilize financial tools and apps to enhance your management skills effectively.

12.1. Recommended Textbooks and Online Courses

Key textbooks include “Personal Finance” by Diana J. Beal and “The Infographic Guide to Personal Finance” by Michele Cagan. Online courses on platforms like Coursera and Udemy offer flexible learning. Resources like Khan Academy and edX provide free courses on money management. These materials cover budgeting, investing, and debt management, offering practical insights for effective financial planning and skill development.

12.2. Financial Tools and Apps

Popular financial tools include Mint, You Need A Budget (YNAB), and Personal Capital. These apps offer budgeting, expense tracking, and investment monitoring. They help users monitor spending, set financial goals, and save money efficiently. Many apps are accessible via iOS and Android, making financial management convenient and accessible for everyone.

Mastering personal finance involves understanding budgeting, saving, investing, and credit management. Continuous learning and adapting to financial changes ensure long-term stability and success in managing your finances effectively.

13.1. Summary of Key Concepts

Personal finance encompasses budgeting, saving, debt management, and investing. Key concepts include understanding financial literacy, building emergency funds, improving credit scores, and planning for retirement. Effective financial planning involves setting clear goals, monitoring expenses, and adapting strategies to life changes. Continuous learning and the use of resources like textbooks and online tools are essential for achieving long-term financial stability and success.

13.2. Final Tips for Successful Financial Management

Start with a clear financial plan, automate savings, and regularly review budgets. Avoid lifestyle inflation and prioritize needs over wants. Build an emergency fund and maintain good credit habits. Stay informed about market trends and adapt strategies as needed. Use reliable resources like textbooks and financial tools to guide decisions. Consistent effort and discipline are key to achieving long-term financial success and security.

Be First to Comment